Everyone wants to have a #1 keyword ranking on Google and everyone also knows that 99% of organic clicks happen on the first Google search results page (SERP). But can a direct-to-consumer (D2C) brand compete in today’s world, where Google gives prominent rankings to Amazon, integrates its own products, and favors informational review sites even more after the BERT algorithm update?

After doing a few consumer product searches on Google, I was surprised to see just how few brands were showing up in SERPs. Being both the curious and analytical sort, I thought it would be interesting to see exactly how the D2C brands were doing in the consumer packaged goods vertical.

Let’s talk about what’s going on in SERPs

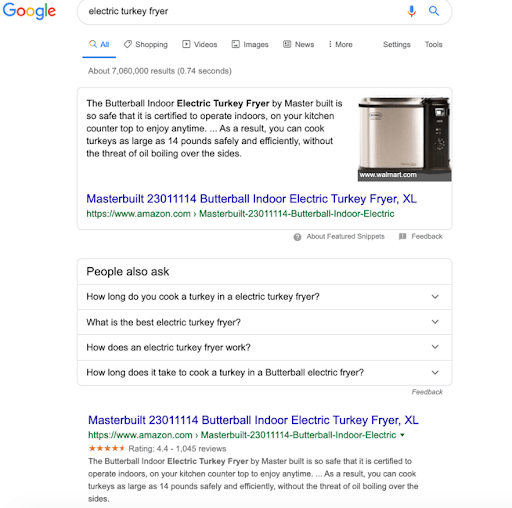

First off, Google likes variety in the SERPs. They recently rolled out an algorithm update in June 2019 to limit how many times one domain can show up. So in theory, this would limit the number of times Amazon.com would show in the SERPs. But did it? Nope. Amazon URLs showed up in the Top 10 rankings a total of 122 times — and twice on 26 out of the 100 CPG keyword searches.

Amazon also showed up 3 times for ‘electric turkey fryer,’ essentially holding all of the ‘above the fold’ space outside of ‘People Also Ask.’ It’s interesting that Amazon has determined the Masterbuilt Fryer as their “Amazon Choice,” which leads to a lot of visibility for Masterbuilt in the Google results.

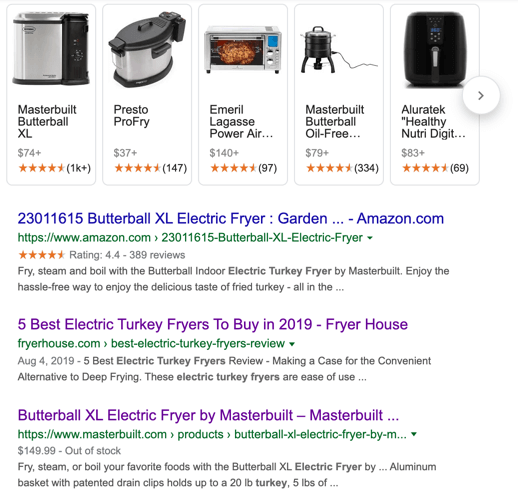

This SERP is also a good example of how Amazon and Google collectively take up a lot of visibility in search results, as the next section below the fold is Google Shopping (followed by another Amazon result). After that, I can read a review that tells me the Masterbuilt Butterball MB23010618XL is the Top Rated Electric Turkey Fryer in 2019, and it uses an affiliate link to send me to Amazon.

Finally, I get to a listing from Masterbuilt but Google is showing that the product is “Out of Stock” even though Masterbuilt doesn’t actually sell the Fryer on their website (WTF?). And again, all of this directed me back to Amazon. All roads lead to Amazon, it appears.

After all this SERP content on the Butterball XL Electric Fryer, I assumed the next listing for a Butterball Indoor Electric Turkey Fryer from Bass Pro Shops would be a great deal, but it is a smaller unit.

Funny side note: this indoor fryer is actually categorized into their Camping Gear > Camp Stoves & Cooking sub-category. Who is using an indoor fryer on their camping trip?

As I work down the results, I also noticed that Google was showing me a map for Home Depot, Walmart, and Bed Bath & Beyond. I could see that Walmart has both a product listing and a category search, so I figure that my two options are now to buy online from Walmart or Amazon, or I could probably drive over to Walmart and get one there.

What’s going on here?

The #1 goal of Google is to provide the best search results. They have 80% share in the search engine market because their results are supposedly the most useful to the person doing the search. Their RankBrain and BERT algorithm updates supposedly use machine learning and natural language processing to build the best results when someone searches.

So every time that Google searches for a CPG (Consumer Packaged Good), the algorithms attempt to bring back the most useful results for that keyword query. As we have seen, this means we will probably see at least one listing from Amazon, but is there consistency in the types of results that Google shows when presented with our sample set of keywords?

Does Google like Consumer Reviews? Do the algorithms have a preference for trusted brands? I had so many questions rolling around in my head. So, I called up the guys over at Authority Labs (our keyword tracking technology partner) to see if they could pull data for me on 100 different CPG keywords to help me get an idea of what is going on.

Researching 100 CPG search queries

Once Authority Labs’ pulled ranking data for us on 11/12/19, we were definitely surprised to see that only one D2C brand usually showed in the Top 10. On top of that, the average ranking position for the D2C brand found in SERPs was 6.3. A #6 position will see approximately 2.5% – 3.5% click-through depending on desktop or mobile devices (CTR Study). This means Google is going to send approximately 3% of SERP clicks toward a D2C brand and will usually only show one D2C brand in a query’s result set.

Here are a couple of other high-level findings:

- Google products and Amazon dominated the top position, accounting for 52% of the #1 rankings.

- Retailers (e.g. Walgreens) definitely showed well, with a Top 3 ranking for 18.3% of search queries.

- Only six D2C brands were able to grab the #1 spot. These are strong brands in a specific niche (e.g. Fabletics).

- Retailers (e.g. Walgreens) definitely showed well, with a Top 3 ranking for 18.3% of search queries.

For the CPG-type queries Authority Labs pulled for us, we also have the following information about the listings showing up in the Top 10:

- Google Shopping (16.5%) – It is above the fold in a Top 3 position. This occurred 100 times out of 100 CPG searches.

- Amazon (20.9%) – They often show up twice while also holding the top spot 23 times out of 71 times (when Google doesn’t take the #1 position).

- Review Site (25.8%) – Reviews, informative products, and lists of the Top 5 or the Best 7 showed up more than any other type of content. These were also positioned towards the top of the results.

- Retail Stores (20.9%) – Collectively, mass retailers (e.g. Target, Walmart, etc.) and specialty retailers (e.g. Bed, Bath & Beyond) showed up as often as Amazon. However, they were typically positioned in the middle to the bottom of the SERPs.

- Direct-to-Consumer Brands (10.2%) – As mentioned before, D2C Brands averaged only 1 position in the Top 10 rankings and held the worst average position at 6.3 out of 10. Only 18 of the 100 searches positioned a D2C consumer brand in the Top 3.

- Marketplace Brands (14.4%) – These niche brand product aggregators (e.g. www.babyjogger.com) were shown more often and often higher on the page than single brands, but not by much.

What does all of this mean? Google thinks that shoppers who search are undecided and want to research (Source: Think with Google). This would explain why the reviews and lists are so visible in these CPG search queries.

What else is happening here? Well, we know that Google also wants to help themselves. That’s why they show a lot more of their search features, including the Shopping Feed, which is another form of ad generation.

Here are just a few of the search features that also show up in SERPs — and all are conveniently owned by Google:

- Rich Snippets

- People Also Ask

- Local Results

- Direct Answers

- Featured Videos

- Shopping

- News

In May of 2019, Google also launched its new shopping experience, which was pretty much directly designed to lure shoppers away from Amazon. These new shopping results dominate SERPs for any CGP search, making it even tougher for CGP brands to gain visibility. Google has gone all-in to counter Amazon with its revamped Google Shopping experience. This means that CGP searches are even more crowded! Of course, there’s also Amazon to contend with.

Let’s talk about online marketplaces

Amazon has seen a meteoric rise in its organic search presence. Because Amazon has cornered the online shopping market, most SERPs take shoppers directly there. After all, Google is designed to give people what they want. Amazon dominates in traffic, as well as backlinks and affiliate programs. All of this leads to listing authority that can be hard to beat. (Recall that in our CPG research alone, Amazon accounted for 20.9% of SERPs — sometimes even showing up twice.)

Amazon’s massive web footprint is trusted by consumers, and its product catalog is ridiculously extensive. Their own search engine rivals Google’s, with machine learning, AI, and natural language capabilities. Basically, consumers know they can find what they need on Amazon.

In looking at the particular Amazon URLs that ranked in the Top 10, we saw several different types of content that are doing well. Here is a rundown:

- Product Listing Pages (37) – When a product ranks well, there is typically a lot of great content.

- Category Pages (36) – Most category pages have Best Sellers and Top Rated sections.

- Top Selected Pages (27) – These seem to be curated pages by Amazon.

- Best Seller Pages (20) – Example – Portable Bluetooth Speakers.

The first takeaway from reviewing these Amazon pages should be how much content can truly go into promoting a single SKU. This Spikeball product listing page has well-done graphics, fun videos, over 2,000 reviews of the product, and can say “As seen on Shark Tank.”

The other takeaway is that almost 70% of the ranking Amazon pages are category results. These category results are also optimized for the shopper, with helpful lists anywhere from Top Rated to Most Gifted at the top of the page before showing the actual products in the category. Here is an example for Bowling Bags.

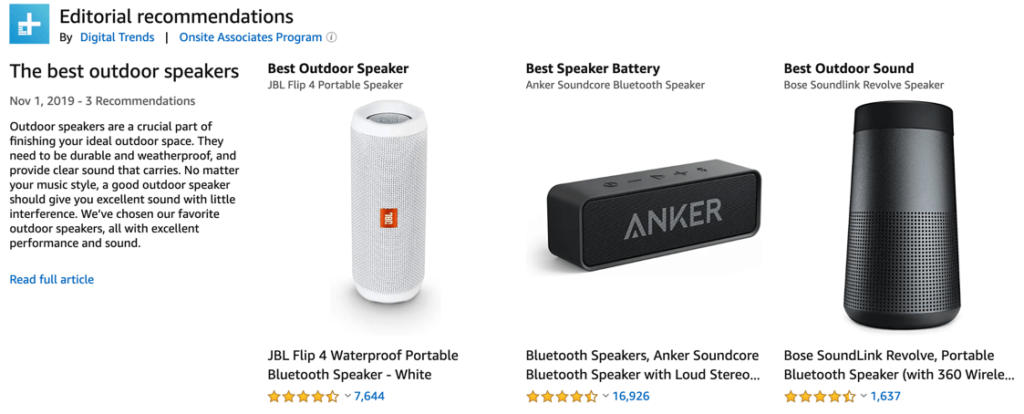

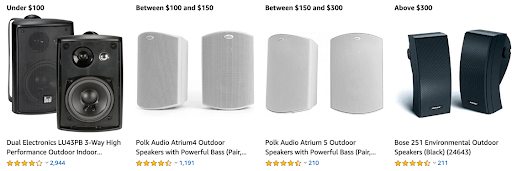

Many of the category pages also contain editorial recommendations. Here is an example recommendation for ‘outdoor speakers’, including categories for best speaker battery and best outdoor sound.

Amazon has mastered how to build category pages that help shoppers review products and make a purchase decision without ever leaving their website. Clearly, this type of shopping experience is more difficult for a single brand to duplicate, but you may find that you can compare multiple SKUs to help a shopper compare your products or perhaps categorize by price range to help them find their way around your product offerings.

Other more niche online marketplaces also have some competitive reach in SERPs. That’s because they’re taking advantage of those niche searches, and they have built authority and trust with those specific consumer groups. Like Amazon, these marketplaces have usually invested in top-of-the-line eCommerce pages and catalogs and have a strong selection of products. Many of them can cater to users’ desire to compare, find the best product, review top-ranked options, etc.

What you really need to take away from this

This can feel a bit overwhelming, and even make it seem like you’re fighting an uphill battle if you’re running an e-commerce site in the Age of Amazon and Google. But here’s what you really need to know so you can really make an impact with the action steps we’re about to provide.

-

- Google and Amazon are the overwhelming favorites when it comes to CPG SEO rankings. Together, they comprise:

- 52% of the #1 results

- 50% of top 3 results

- 29% of all first page results

- After that, retailers have the next best chance to achieve meaningful SEO results, with:

- 10% of the #1 results

- 18.3% of top 3 results

- 20.9% of all first page results

- It’s a tough SEO environment for D2C brands. They occupy an exceptionally small percentage of SEO ranks:

- Only 6% of the #1 results

- Only 5% of the top 3 results

- Only 10.2% of first page results.

- Google and Amazon are the overwhelming favorites when it comes to CPG SEO rankings. Together, they comprise:

Options & Opportunities for D2C brands

It may seem hopeless in light of the situation, but there are some things that can be done to help capture search traffic from Google for your direct-to-consumer (D2C) brand for CPG products:

-

- Brand Campaigns: Seek to generate as much brand-specific buzz as you can, so people aren’t just looking for your products. They’ll be looking for your brand.

- Brand Presence: Ensure that you have maximized your presence in every corner of the internet where your brand can show up. (e.g. business profiles, knowledge panels, local results, rep management results, etc.)

- Retail Shelf Space – Mass retailers and a few specialty retailers show up well in Google SERPs. Of course, we know how valuable it is to have your product on retail shelves but it can also help your SERP visibility to be carried by retailers. Whether you have retail distribution or not, keep an eye on how any products carried by retailers show up in SERP results for possible improved visibility in rankings.

- Google Homepage: Consider the totality of all results that show up for your brand by doing a Google search. You need to seek to influence and have each listing be represented as strongly as possible. Optimize and enhance any pages you can control and work with third party sites to improve the content and conversions for other pages that rank well that you don’t have control over.

- Single Keyword Landing Pages: The single keyword landing page concept has proven to do much, much better at converting than landing pages. Consider building these types of pages out for top terms.

- SEO Best Practices: Speed up and optimize your pages. The resources you currently have on your site need to be technically perfect and super fast.

- Zero-Click Search Optimization: Seek to claim valuable, answer-focused SERP real estate to take advantage of zero-click searches.

- In-depth content: Offer more in-depth, useful content about your own products than most big e-commerce sites and marketplaces.

- Advertising: Buying ads and controlling that critical real estate at the top of the SERPs should be part of your overall search strategy.

- Content Marketing: Help brand and product buzz as a whole so that you can build authority, trust, and traffic. This will include content like:

- Video – YouTube content, promoted videos, and video overlays are all good ways to take advantage of the internet’s 2nd largest search engine.

- Social Media – Instagram and Facebook offer the opportunity to capture your target audience’s attention.

- Third-Party Reviews – Try to get listed for “Top”and “Best” content on third-party sites, where different brands are reviewed for consumers.

- Influencers – Start with micro-influencers and brand ambassadors who can tap into a wider audience while building trust and authority in your brand. Remember, your brand is how you stand out in a saturated market and these influencers are often your key to those audiences.

- Online PR – Reach out to potential product partners, associations, podcasts, and anyone who could tell a wider set of your ideal audience about your brand and product.

Using this data in your favor

The truth is: these numbers (and the current SERPs landscape in general) can feel really discouraging for brands who are trying to get visibility, traffic, and sales. A larger Amazon presence + more Google shopping + more Google featured results + more diversity in the SERPs = a very difficult organic landscape for D2C brands, or really anyone for that matter.

But this doesn’t mean it’s not possible to succeed in SERPs. It means that you need to be more strategic, more intentional, and more consistent with your SEO, content marketing, and brand awareness. Focusing on getting your brand in the places it matters — and in front of who matters to you — will help build the traffic and authority you need to climb in SERPs.

Volume Nine has helped hundreds of clients find success in SERPs, as well as improve their eCommerce brand’s sales and reach. If you want our help going up against Amazon and Google in SERPs, let us know.